In the ever-evolving business landscape of Missouri, from the bustling streets of St. Louis to the serene hills of the Ozarks, companies of all sizes are continuously seeking ways to enhance their financial health and competitive edge. One strategic decision that can significantly contribute to achieving these goals is hiring a business accountant. This move is not merely about managing numbers; it’s about unlocking a wealth of benefits that can propel a business toward sustainable success.

Expert Financial Guidance

First and foremost, a business accountant offers expert financial guidance tailored to your company’s unique needs and challenges. Missouri’s economy is diverse, spanning various sectors such as agriculture, manufacturing, and services. A skilled accountant brings a deep understanding of this economic landscape, providing insights and strategies that align with your business objectives and regulatory requirements. This level of expertise is invaluable in navigating the complexities of financial management and growth planning.

Compliance and Risk Management

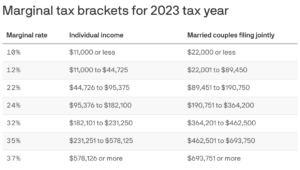

Missouri’s tax laws and business regulations can be labyrinthine, posing a challenge for businesses aiming to stay compliant while maximizing their financial efficiency. A business accountant stays abreast of the latest tax codes and regulatory changes, ensuring your company adheres to all legal requirements. This proactive approach to compliance not only avoids costly penalties but also identifies tax-saving opportunities, reducing overall financial risk.

Time and Resource Optimization

For most business owners, time is a precious commodity. Managing your company’s finances can be time-consuming, diverting attention from core business activities. By entrusting these tasks to a business accountant, you free up valuable time and resources. This enables you to focus on strategic business development, customer engagement, and other critical areas that require your expertise.

Informed Decision Making

Access to accurate, timely financial data is crucial for making informed decisions. A business accountant ensures your financial records are meticulously maintained, providing a clear picture of your business’s financial health. This clarity enables better budgeting, forecasting, and strategic planning, facilitating decisions that drive profitability and growth.

Cost Savings and Profit Maximization

Identifying areas of unnecessary expenditure and potential revenue enhancement is another benefit of hiring a business accountant. Through detailed financial analysis, they can pinpoint inefficiencies, suggest operational improvements, and implement cost-control measures. Additionally, by analyzing financial trends and market opportunities, they can advise on pricing strategies, investment opportunities, and other avenues for profit maximization.

Customized Financial Strategies

Every business in Missouri has its own set of goals, challenges, and opportunities. A business accountant develops customized financial strategies that reflect your specific business model, market position, and long-term objectives. Whether it’s cash flow management, debt reduction, or investment planning, these tailored strategies are designed to support your business’s growth and sustainability.

Building Financial Credibility

Having a reputable business accountant also enhances your company’s financial credibility among investors, lenders, and partners. Accurate, professionally prepared financial statements and reports demonstrate fiscal responsibility and stability, fostering trust and confidence in your business.

In conclusion, hiring a business accountant in Missouri is a strategic investment in your company’s future. The expertise, insights, and services they provide are not just about keeping your financial house in order; they’re about unlocking the full potential of your business. Whether you’re a budding startup or an established enterprise, the benefits of professional accounting support are clear: improved compliance, enhanced decision-making, optimized resources, and a solid foundation for growth and profitability.